How Does a Cedar Rapids Foreclosure Impact Your Credit Score?

How does a Cedar Rapids foreclosure impact your credit score? When you miss a mortgage payment, your financial situation just became severe. You are in default, and you’d better do something fast, or foreclosure threatens. You could lose your home, and the impact of foreclosure on your credit can blow up your credit report. That will leave you in the cold for seven years from the date of your first missed payment. According to U.S. News, During that time, lenders can view your creditworthiness as unlikely to pay back money loaned.

How Does a Cedar Rapids Foreclosure Impact Your Credit Score?

Financial Samurai tells us, “if your FICO credit score is 680, a foreclosure will drop your credit score on average by 85 to 105 points. If your credit score is excellent at 780, a foreclosure will lower your score by 140 to 160 points. In other words, the higher your credit score, the more it will get smashed!.

What are FICO credit scores?

Caroline Mayer, a consumer blogger, says, “It’s an algorithm designed to predict your likelihood of repaying debt. Lenders use your score to determine whether to approve you for loans and credit cards and at what interest rates. Insurers use credit scores to set premium rates, and employers use them when making hiring decisions.

FICO credit scores run from 300, considered the highest risk of default, to 850, the lowest risk. Though FHA for years has accepted applicants who have FICO scores in the 500s, the practical reality has been that most lenders ignore borrowers whose scores are under 620 or even 640.

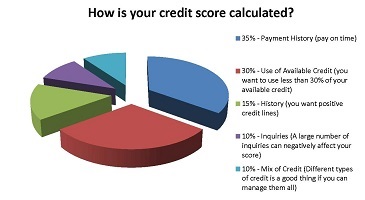

How are FICO credit scores calculated?

Your score is based on many different pieces of credit data in your credit report. This data is grouped into five categories, as outlined below. The percentages in the chart (above) reflect how important each of the categories is in determining how your FICO credit scores are calculated.

If you don’t know your FICO credit score, you can request a free copy of your credit report then check it for errors, such as late payments incorrectly listed for any of your accounts and that the amounts owed for each of your open accounts are correct. If you find errors in any of your reports, dispute them with the credit bureau.

There Are Steps You Can Take to Avoid Foreclosure

Contact your lender

and level with them. They have seen this before and will demand you take steps to fix it. Fixing it may require you bring your mortgage current, selling your toys, and making significant cuts in your spending.Do not ignore your mail

. Many have been in your shoes. The first thing many did when the mail arrived was to avoid bad news and throw the bills in a drawer. Those first envelopes will contain helpful suggestions to get your finances under control. Then will come legal action. Ignoring these notices can cause you to lose everything.Contact Professionals

Your banker may be able to refinance the loan, or your creditors may be able to give you repayment options. Contact a credit counselor. Sure, you will feel like a failure or worse, but take responsibility for your actions. Contact a bankruptcy attorney. That sounds contrary to taking responsibility, but you need to know your options so you can make informed decisions.Contact a professional real estate investor

You may want to sell your home fast to get out of the problem or to save your credit rating, Harmony Property Solutions, LLC, is here to help homeowners out of any kind of distressed situation. As investors, we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. We offer the simple honest truth about your home and how we can help you sell it fast to resolve any situation.We will send you FREE information about How to Sell Your House Fast.

Harmony Property Solutions, LLC,

is part of a nationwide group of thousands of investors who are helping tens of thousands of homeowners every year. We may not be the “traditional” route, but we CAN help, and we can do it quickly!Give us a call today at 319-343-6773 to let us know how we can help you.