S&P/Case-Shiller Index

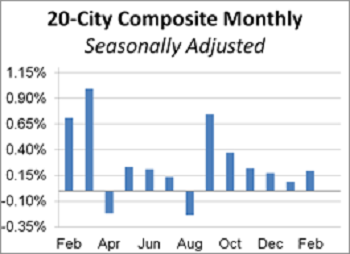

The latest S&P/Case-Shiller Index numbers dropped. With today’s release of the February S&P/Case-Shiller Home Price Index, we learned that seasonally adjusted home prices for the benchmark 20-city index were up 0.20% month over month. The seasonally adjusted national index year-over-year change has hovered between 4.2% and 6.7% for the last two-plus years. Today’s S&P/Case-Shiller National Home Price Index (nominal) reached another new high.

S&P/Case-Shiller Index

The history of the index is pretty fascinating. For a long time, we were mostly in the dark on how home prices change over time. That all changed thanks to Robert Shiller, a Nobel Prize-winning behavioral economist, who co-created this index with his colleague Karl “Chip” Case (as the name would suggest).

So Shiller knows the housing market, and he has long been skeptical of whether buying a house is really a surefire investment. His index shows that home prices haven’t really grown much over the long run. Should you use your life savings to buy a home? It’s debatable.

The long-run growth of home prices is pitiful

In his classic book Irrational Exuberance, Shiller looked at the history of home prices going back as far as 1890. He found that they’ve gone up and down, but over the long haul, they’ve actually grown very little. Between 1890 and 2019, national housing prices grew by less than 0.6 percent per year (after accounting for inflation). That’s pitiful! To put that number in perspective, the average real return of the S&P 500, the index of the stocks of the top 500 corporations in America, is about 7%.

Shiller is not alone in finding that home prices haven’t climbed much over the long run. Mostly that’s because we’ve built more. That said, there is some evidence that across advanced countries, home prices have been trending upward since WWII, and that could be because development has slowed.

Before Our Own Eyes

I realize it is not reasonable to argue with experts, but their opinions defy what’s been happening before our own eyes. In Portland in 1968, my wife and I bought a house for $14, 400. It was on a 60 by 160 foot lot with a two bedroom one bath house about 2000 sq.feet in size. In 1979 we sold the house for $42,400. Then in 1993, we bought a house on the same side of town, but closer to city center by 30 blocks. We paid $154,000 for the house, again about 2000 sq feet, 2 bathrooms, and three bedrooms. In 2014 we sold the house for $459,000. Those were both triples in our lives.

The equity build in both cases was substantial, mainly because of paying down the mortgage over time. If we had rented, all we paid in the form of rent would be lost. I realize we are counting property taxes which are certainly high in Portland as are upkeep and maintenance, but I’ll stick with owning rather than renting.

We will send you FREE information about How to Sell Your House Fast.

Harmony Property Solutions, LLC is here to help homeowners out of any distressed situation. As investors, we are in business to make a modest profit on any deal. However, we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple, truth about your home and how we pay cash for houses Cedar Rapids.

Harmony Property Solutions, LLC is part of a nationwide group of thousands of investors who are helping tens of thousands of homeowners every year. We may not be the “traditional” route, but we CAN help, and we can do it quickly!

Give us a call today at 319-343-6773 to let us know how we can help YOU.